Citi: Foundation for Human Growth

Identifying CITI’s place in culture

Problem

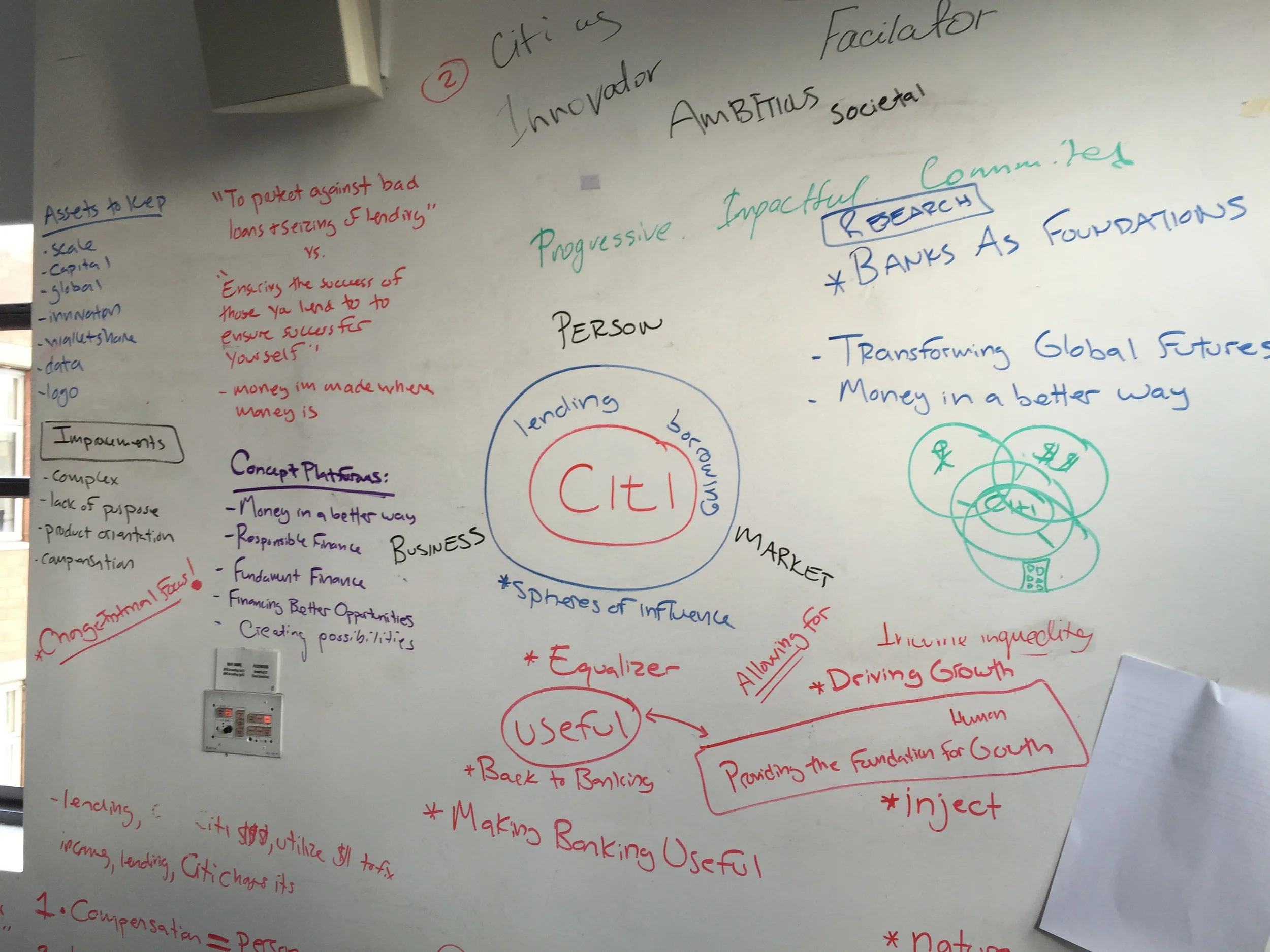

Through research, which consisted of interviewing CITI employees, CITI Customers and banking professionals, we were able to identify CITI's key challenges.

CITI has overly complicated brand architecture, coupled with no core brand purpose, which lead them to focus their financial innovations on serving profits over people as opposed their customer and clients' needs.

Background

CITI was founded in 1812 and for the past 200 years has been at the forefront of the financial innovation. They introduced many financial products that we use today: unsecured personal loans, checking accounts, compound interest on savings, 24 hour banking, ATM, credit card and etc.

In 1998, Citi merged with Traveler’s insurance and created Citigroup, which became known as supermarket bank. Since then CITI has been on the decline. CITI turned away from the innovative culture and towards making money. This left them vulnerable in the 2009 Financial crisis. CITI had to be bailed out to the tune of 325 billion dollars, more than any other bank. Needless to say people were angry and CITI became public enemy number one. CITI has lost its place in culture. Since 2009, Citi has been trying to reinvent itself and recover, but has not been successful.

PROCESS

We begun by diving deep into the history of CITI. We analyzed financial industry as a whole. We reviewed CITI's communications. We interviewed CITI employees, CITI Customers and banking professionals to get a better picture of CITI's perception in the world. We also sent out a survey to understand how Millennials view banks and financial system as a whole. Through the survey, we also acquired Millennials viewpoint on the bank's place in the society in the 21st century. After thorough research, it was time to find solutions. We utilized a combination of frameworks to streamline our thinking in order to arrive at our overarching strategy.

BRAND STRATEGY

Citi is to return to their history of innovation by re-aligning their brand architecture with the core benefits of banking and committing to the purpose of creating opportunities for the future.

This can be accomplished in five parts. By identifying new core purpose for CITI, by restructuring brand architecture, by shifting focus to customer based innovation, by addressing leadership and by changing compensation structure.

NEW POSITIONING

CITI'S CORE PURPOSE

BRAND ARCHITECTURE

Current CITI Brand and Organization Architecture is messy and has a lot of redundancies. Departments do not interact with one another, therefore, creating broken brand and company. We propose putting CITI in the middle, uniting the company underneath one brand, CITI. Now, everyone works for CITI and not for the CITI Investment Bank or CITI Consumer. CITI is being supported by Markets, Commercial and Institutional arms.

CURRENT BRAND ARCHITECTURE

PROPOSED BRAND ARCHITECTURE

INNOVATION

CITI is a financial behemoth. It is slow moving and is not able to innovate quickly enough. Therefore, CITI is to create strategic partnerships within key financial areas: Consumption, Financing, Investment and Banking. Companies like Venmo, Lending Club, Wealthfront and Simple are disrupters to the financial sector. They are utilizing agile development and are able to quickly test all of their products. They are already using CITI's capital reserves and it only makes sense that CITI partner up with them, in order to provide the best financial tools for its customers.

LEADERSHIP

In order for CITI to make a turnaround, it needs to address their Leadership approach. Right now CITI Leadership utilizes top to bottom approach. In order for the new organizational structure to work, CITI's leadership needs to pass down decision making to the smaller groups. Because smaller teams are the ones that deal with the day to day problems and they need to make decisions quickly in order to be the most effective.

COMPENSATION

In order to change the culture of CITI and banking overall, we cannot forget the compensation. Currently CITI compensation is standard. It is based on employees' performance and how much they attribute to the bottom line. We propose that CITI employees' compensation is based on direct customer performance.

NEW COMPENSATION STRUCTURE

CURRENT COMPENSATION STRUCTURE

TARGET AUDIENCE

We have identified three keys audiences

Developed Banking Communities

For these CITI's customers, banks are part of the everyday life. They use banking and financial services almost every day. However, they interact with their banks through the ATMs or a mobile app. They also utilize third party apps such as Venmo.

Underserved Banking Communities

These are the areas where major banks have little or no presence at all. They are deemed to be unprofitable. But these are the ones that need financial guidance the most.

Unbanked Communities

There are 2.5 billion people that do not have access to the banking system but the communities have access to the mobile phones. They have set up their own financial barter systems. They use mobile minutes as the currency.

BRINGING THE VISION TO LIFE

CITI has thousands of branches throughout the world. People mostly interact with bank either through the ATM or mobile app, therefore eliminating the need for the physical space. Our idea for CITI SPACES is to transform existing CITI branches into community spaces, where CITI clients and customers can come in and use the space for their business needs. This concept works across all three audiences.

DEVELOPED BANKING COMMUNITIES

CURRENT CITI BRANCHES

PROPOSED CITI BRANCHES - CITI SPACES

CITI COMMUNITY MANAGER

is a bank teller of the future. He is a facilitator between CITI customers and clients. Community Manager provides financial solutions depending on the customer's needs. For example, for CITI customer who owns a bakery, CITI Community manager will be able to facilitate a small business loan, as well as put him/her in touch with services (delivery company, food supplier and etc.) that he/she needs through CITI network.

UNDERSERVED BANKING COMMUNITIES

CITI SPACES

in Underserved Banking Communities becomes a community and financial education space, where CITI customers can have access to financial services. This where they can learn how they can secure a school loan or business loan, as well as learn how to manage their finances.

CITI COMMUNITY MANAGER

in Underserved Banking Communities, becomes a financial educator. She/He provides the necessary tools for CITI customers to have more opportunities in the world.

UNBANKED COMMUNITES

CITI COMMUNITY MANAGER

is a leader of his/her community. He/She knows what are the needs of his/her people. By utilizing mobile technology, the CITI Community Manager is able to quickly access CITI database and provide funds for his community.

CITI SPACES

in Unbanked Communities, CITI Spaces is a place where they CITI customers can have access to the basic financial tools. It is a space where financial education is taught.

Team: Lana Molodtsova Ugurtas, Jordan Jackson, Kyle Rajaniemi.

Thesis Project: Masters in Branding at School of Visual Arts

Advisors: Bret Sanford, Mark Kingsley